The Hookup Doctor's Guide

Navigating the world of modern dating and relationships.

Splashing in the Deep End: Navigating Marketplace Liquidity Models

Dive into the world of marketplace liquidity models and discover how to thrive in the deep end of buying and selling!

Understanding Marketplace Liquidity: Key Models and Their Impact

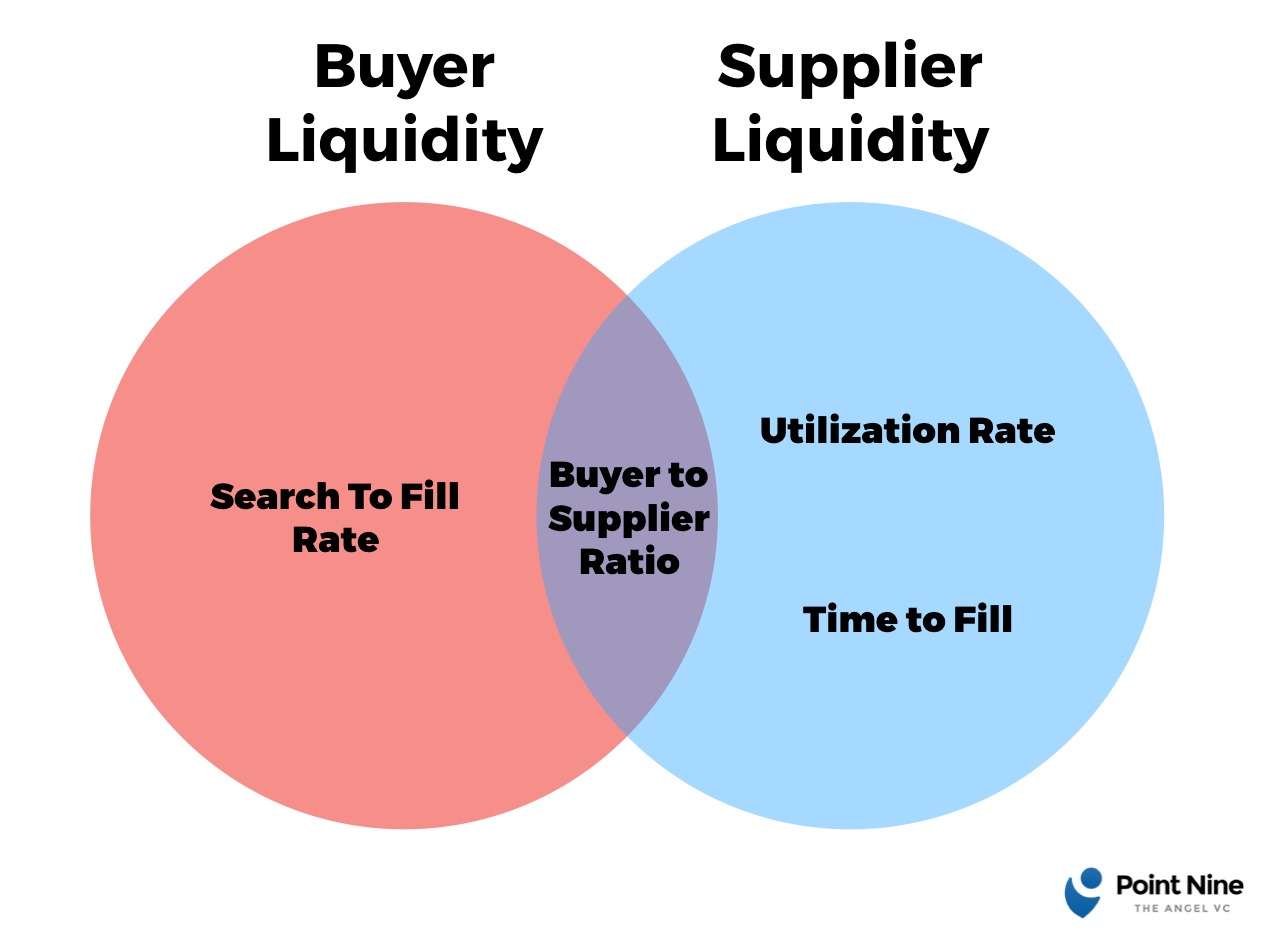

Marketplace liquidity refers to the ease with which assets can be bought or sold in a market without causing a significant impact on their price. Understanding the concept of marketplace liquidity is crucial for investors and businesses alike, as it directly affects trading strategies and investment decisions. Key models of marketplace liquidity include the order book model, where transactions are executed based on a list of buy and sell orders, and the liquidity pool model, commonly used in decentralized finance (DeFi), where users contribute assets to a pool to facilitate trading. Each model carries its own implications on market efficiency and price stability.

The impact of liquidity on marketplace dynamics cannot be overstated. A highly liquid market typically exhibits narrower spreads between the bid and ask prices, allowing for more favorable conditions for traders. In contrast, a less liquid market can lead to greater volatility and potential slippage, affecting the execution of trades. Understanding how these key models of liquidity operate can help market participants strategize effectively, ensuring they navigate the trading landscape with greater confidence and adaptability.

Counter-Strike is a popular tactical first-person shooter game that requires teamwork and strategy. Players can choose to be part of the terrorist or counter-terrorist team, engaging in various mission objectives. For those looking to enhance their gaming experience, utilizing a daddyskins promo code can provide significant in-game benefits.

The Effects of Liquidity on Marketplace Valuation: What You Need to Know

The impact of liquidity on marketplace valuation cannot be overstated. Liquidity refers to how quickly and easily assets can be bought or sold in the market without affecting their price. A marketplace with high liquidity often enjoys a higher valuation due to the ease with which transactions can occur. This is particularly important for investors as it minimizes the risk associated with asset price fluctuations. Additionally, the perception of a liquid market can attract more participants, thereby driving up demand and ultimately, the value of the assets involved.

On the other hand, low liquidity can lead to undervaluation of assets. When a marketplace experiences lower liquidity, sellers may struggle to find buyers, which can result in longer holding periods and significant price discrepancies. Therefore, understanding the effects of liquidity is crucial for stakeholders in determining the fair valuation of assets. In summary, a liquid marketplace enhances value by fostering confidence among investors, while low liquidity can hinder market performance and valuation stability.

How to Choose the Right Liquidity Model for Your Marketplace

Choosing the right liquidity model for your marketplace is crucial for fostering a vibrant trading environment and satisfying user needs. A liquidity model dictates how easily assets can be bought or sold without causing significant price fluctuations. When assessing your marketplace's needs, consider various factors such as the type of assets traded, user base size, and market conditions. For instance, a marketplace focused on high-frequency trading might benefit from a continuous liquidity model, while a smaller niche marketplace may find a periodic liquidity model more effective.

Additionally, it is important to evaluate different liquidity provision mechanisms, such as order books and automated market makers (AMMs). Each of these mechanisms presents unique advantages and challenges. An order book model allows for transparent price discovery but may struggle with lower trading volumes. Conversely, AMMs can provide consistent liquidity, but they introduce risks like impermanent loss. Take the time to analyze your audience's trading patterns and preferences to select a liquidity model that not only meets immediate needs but also supports long-term growth and stability.